Intrafi Network Deposits

IntraFi Network Deposits is a smart, secure and convenient way to safeguard your deposits.

PeoplesBank can offer 100% Federal Deposit Insurance Corporation (FDIC) insurance coverage to customers through our relationship with IntraFi and the programs they offer.

Who can use IntraFi Network Deposits?

Individuals with large deposits, businesses of all sizes, non-profits, government and municipal entities can all use IntraFi.

Contact your Relationship Manager or local Banking Center Manager to learn more.

The Benefits of the IntraFi Network through PeoplesBank.

![]()

It's simple

With a single, trusted bank relationship, all your deposit balances are protected - no need to move funds around manually.

![]()

Peace of mind

Enjoy the safety and simplicity that comes with access to full FDIC insurance coverage, up to $150 million per relationship.

![]()

Save time

Save time by working directly with PeoplesBank, a single financial institution, one that you know and trust.

How it works

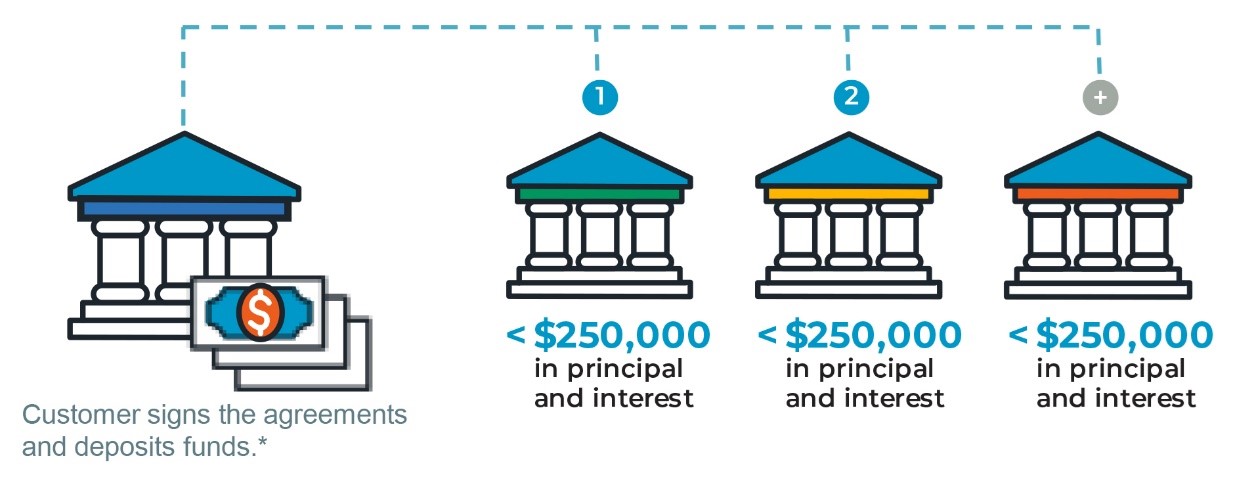

When you enroll in IntraFi through PeoplesBank, your deposits are protected over the FDIC maximum coverage of $250,000.

- Through a network of institutions that belong to the IntraFi network, your deposits are divided into amounts under the FDIC maximum and placed in multiple, participating banks in amounts below $250,000. However, even though your funds are divided at other institutions, PeoplesBank remains your point of contact providing one statement and online banking for your full deposit relationship.

- By working directly with PeoplesBank you can seamlessly access the deposit insurance coverage of many banks, but you receive one regular statement from PeoplesBank covering your total deposits.

- Through PeoplesBank, you will continue to have the convenience of 24/7 online access to your full account information.

- To learn more, contact your Relationship Manager or email us at [email protected].